Deep Discount Bonds Meaning

An account is said to be in arrears if the debt liability or obligation expected is. A zero-coupon bond is a type of bond with no coupon.

Discount Bond Definition Examples Top 2 Types Of Discount Bonds

All Series E bonds have matured and are no longer earning interest.

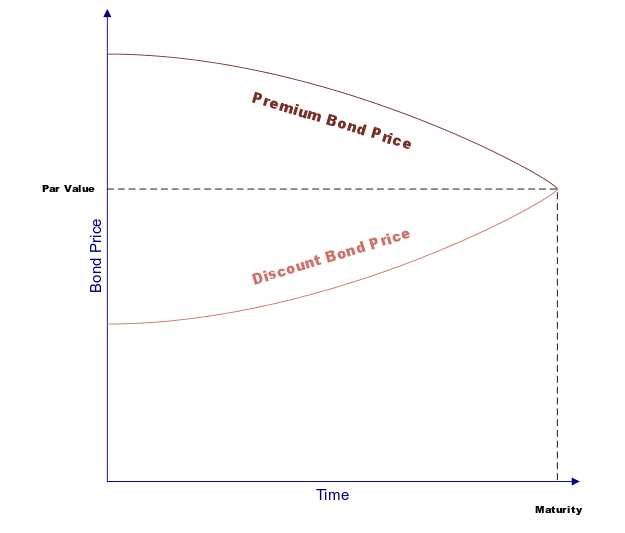

. Deep affection from the bottom of the heart unshakable loyalty and trust. A zero-coupon bond is a debt security that doesnt pay interest a coupon but is traded at a deep discount rendering profit at maturity when the bond is redeemed for its full. Arrears refers to either payments that are overdue or payments that are to be made at the end of a period.

Expression of passion and romance. Take care of yourself. Series EE bonds were first offered in January 1980 and have a maturity period of 30 years.

If you buy 10000 worth of bonds at face value -- meaning you paid 10000 -- and then sell them for 11000 when. Bonds are a lower-risk way to increase your wealth than the stock market. In the event of discount campaigns it is hanged in front of the shop door so that the customer can spot the opportunity.

It is also known as a straight bond or a bullet bond. A plain vanilla bond is a bond without unusual features. Paper Series EE and Series E bonds were issued at a discount and increase in value as they earn interest.

Different Types of Bonds Plain Vanilla Bonds. It is one of the simplest forms of bond with a fixed coupon and a defined maturity and is usually issued and redeemed at face value. But also in the non-romantic context for friendship and strong bonds.

They were offered in paper definitive form until 2012.

Deep Discount Bond Definition And Meaning Capital Com

Discount Bond Definition Examples Top 2 Types Of Discount Bonds

No comments for "Deep Discount Bonds Meaning"

Post a Comment